how to calculate my paycheck in michigan

You can choose between weekly bi-weekly semi-monthly monthly quarterly semi-annual and annual pay periods and between single married or head of household. Choose Cycle Daily Weekly Bi-Weekly Monthly Semi-Monthly Quarterly Semi-Annually Annually Miscellaneous.

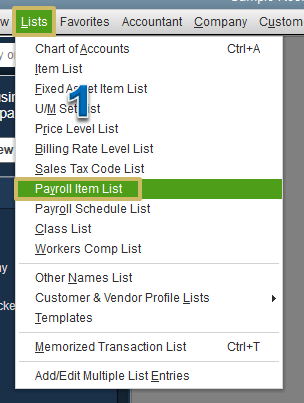

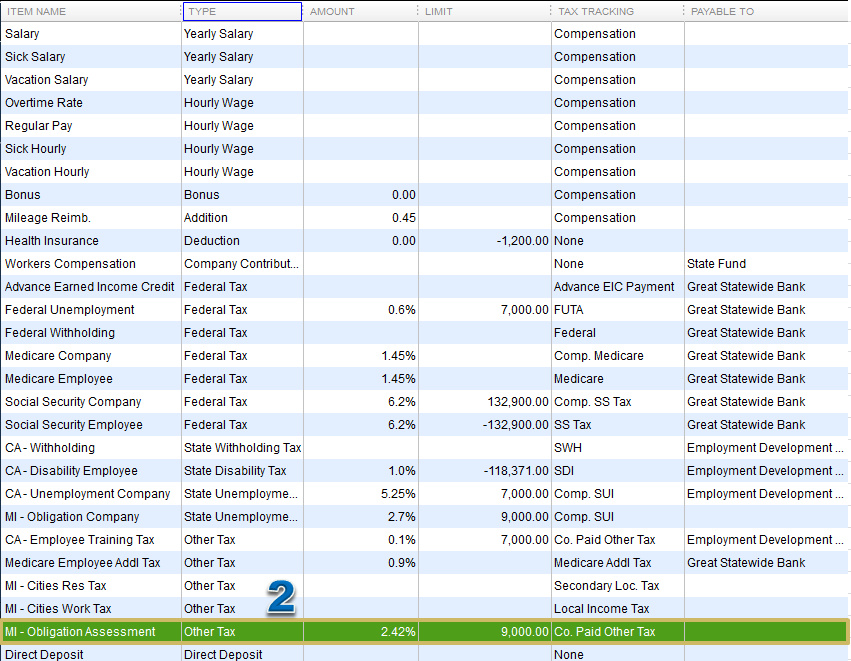

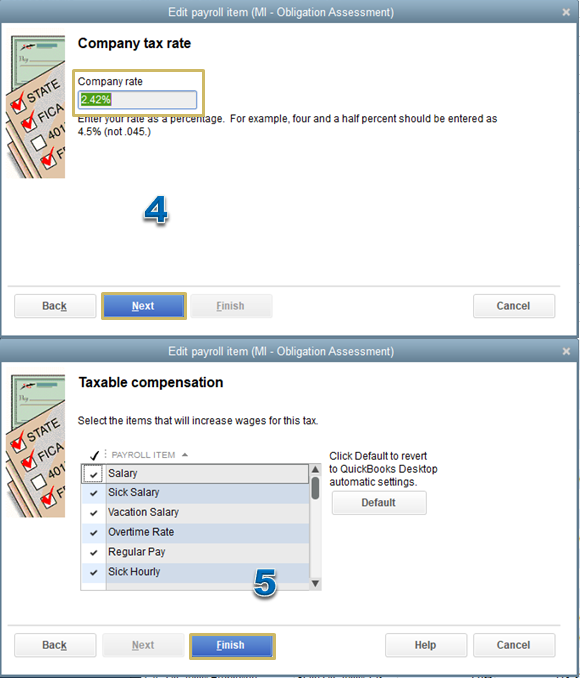

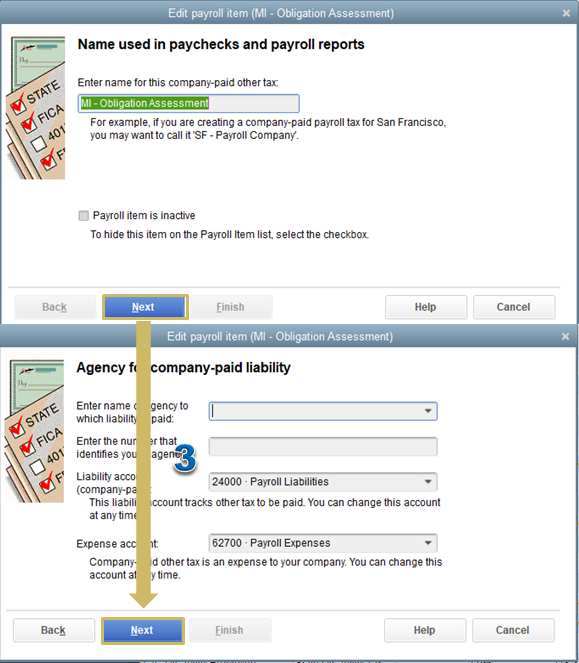

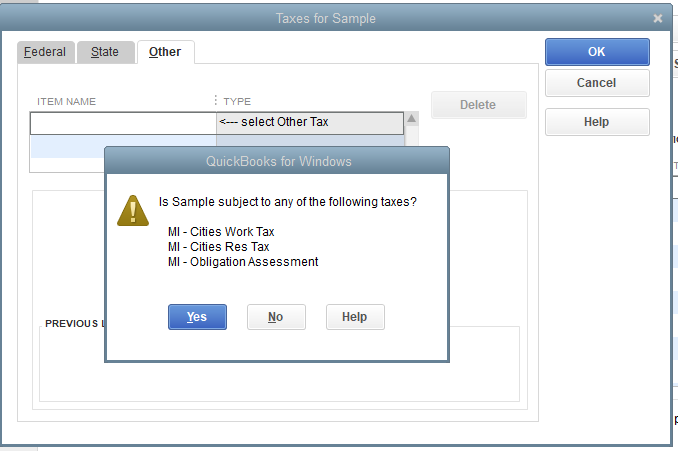

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

Choose Marital Status Single or Dual Income Married Married one income Head of Household.

. Divide the employees annual salary by the number of pay periods per year. Multiply the number of hours worked by the employees hourly pay rate. Michigans Unemployment System Michigan has an experienced-rated tax system that uses the employers payroll unemployment taxes the employer paid and unemployment benefits charged to the employers account to calculate the employers annual tax rate.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Use our Michigan Paycheck Calculator to calculate your take-home pay per paycheck for both salary and hourly jobs after taking into account all taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

For hourly employees. How to calculate taxes taken out of a paycheck. Benefits paid unpaidunderpaid taxes and a fluctuating payroll can all cause a.

The Michigan Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Michigan State Income Tax Rates and Thresholds in 2022. Michigan Salary Calculator for 2022. Supports hourly salary income and multiple pay frequencies.

Make sure to calculate any overtime hours worked at a higher rate. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. In Michigan overtime hours are any hours over 40 worked in a single week.

A Hourly wage is the value specified by the user within GP. Federal labor law requires overtime hours be paid at 15 times the normal hourly rate. Calculating your Michigan state income tax is similar to the steps we listed on our Federal paycheck calculator.

Michigan Overtime Wage Calculator. B Daily wage GP WPD C Weekly wage GP WPD WDW D Monthly wage E 12 E Annual wage 52 C - In case the pay rate is daily. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Total annual income Tax liability All deductions Withholdings Your annual paycheck. Next divide this number from the annual salary. A salaried employee is paid an annual salary.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Michigan is a flat-tax state that levies a state income tax of 425. After a few seconds you will be provided with a full breakdown of the tax you are paying.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Estimate your paycheck withholding with TurboTaxs free W-4 Withholding Calculator. The tax calculator can be used as a simple salary calculator by entering your Weekly earnings choosing a State and clicking calculate.

Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis.

For instance a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount. That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income. To use our Michigan Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Number of Qualifying Children under Age 17.

Figure out your filing status. Overview of Michigan Taxes. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. A Hourly wage GP WPD B Daily wage GP C Weekly wage GP WDW. Need help calculating paychecks.

Details of the personal income tax rates used in the 2022 Michigan State Calculator are published below the. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding.

If you pay salaried employees twice a month there are 24 pay periods in the year and the gross pay for one pay period is 1250 30000 divided by 24. Enter any overtime hours you worked during the wage period you are referencing to calculate your total overtime pay. Lets say the annual salary is 30000.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Michigan. How Your Paycheck Works. Switch to Michigan hourly calculator.

Using our Michigan Salary Tax Calculator. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

- In case the pay rate is hourly. This free easy to use payroll calculator will calculate your take home pay. This is great for comparing salaries reviewing how much extra you will have after a pay rise or simply keeping a quick eye on your tax withholdings.

If you pay your employees twice a month then you have 24 pay periods per year. Alternatively you can choose the advanced option and access. Check if you have multiple jobs.

Switch to Michigan salary calculator. Figures entered into Your Annual Income Salary should be the before-tax amount and the result shown in Final Paycheck is the after-tax amount including deductions.

Successaesthetics Bullet Journal Inspiration Bullet Journal Journal Inspiration

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

Michigan Income Tax Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

Truthful Unemployment Claimants Won T Have To Repay Benefits Despite Michigan Error Whitmer Says Mlive Com

Michigan Kitty Game From My Own Collection Kitty Games Vintage Board Games Vintage Games

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

State Of Michigan Taxes H R Block

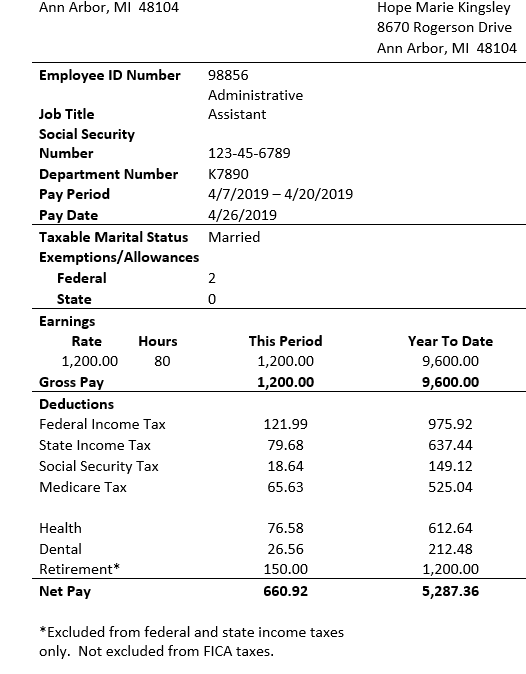

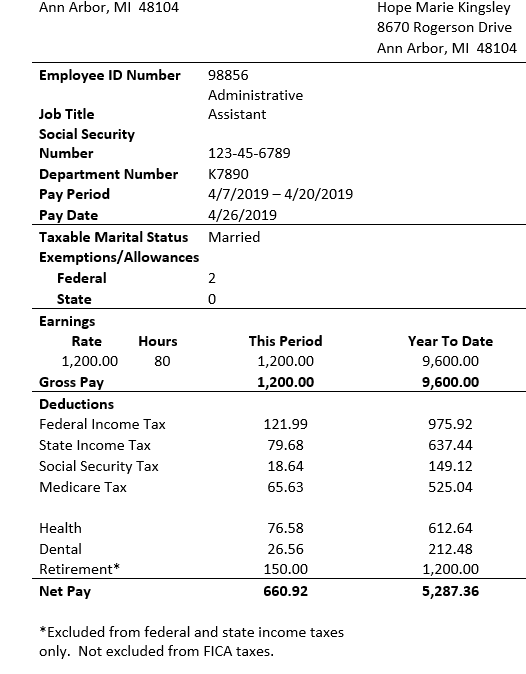

For The Federal And State Taxes The Retirement Is Chegg Com

Michigan Income Tax Calculator Smartasset

Is My Pension Subject To Michigan Income Tax Center For Financial Planning Inc

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

Paycheck Calculator Take Home Pay Calculator

Michigan Sales Tax Calculator Reverse Sales Dremployee

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

Americans Should Be Prepared For A Smaller Tax Refund Next Year

Directpay Merchant Services Merchant Services Retail Logos Merchants

2020 Michigan Good Food Virtual Summit Launch Session Msu Mediaspace